Expensive mortgage loans are pushing more Americans out of the housing market. According to the latest data from the National Association of Realtors, pending home sales in April plunged by 6.3% — far worse than the expected 1% decline — marking the lowest index reading in nearly a year at 71.3. This steep drop coincides with mortgage rates nearing their 2025 highs.

Pending Home Sales (MOM)

The reason? High interest rates driven by the Federal Reserve’s ongoing “higher-for-longer” stance on monetary policy.

A Disconnect Between Policy and Reality

The Fed continues to cite concerns about persistent inflation, but the Personal Consumption Expenditures (PCE) data suggests otherwise — PCE inflation has been steadily declining, indicating that price pressures may be easing. Still, Fed officials remain firmly hawkish.

United States Core PCE Price Index Annual Change

The FXStreet Fed Sentiment Index sits above 110, showing a clear reluctance to shift toward easing. Even traditionally neutral policymakers like New York Fed President John Williams have leaned hawkish, reinforcing that rate cuts are likely delayed until late 2025 at the earliest.

(VISIT BILLY LEE’S FREEDOM FITNESS FINANCE NEWSLETTER)

Housing Hit from All Sides

With 30-year fixed mortgage rates near 6.9% and affordability plunging, both homebuyers and sellers are frozen. Inventory is finally rising — but no one’s buying. “At this critical stage of the housing market, it is all about mortgage rates,” said NAR Chief Economist Lawrence Yun.

30 Year Mortgage Rate US

The numbers back that up: April’s existing home sales also slipped and remain at multi-year lows.

Policy in a Vacuum?

The Fed’s insistence on holding rates high may be an overcorrection. If inflation is easing and housing is deteriorating, shouldn’t monetary policy adapt?

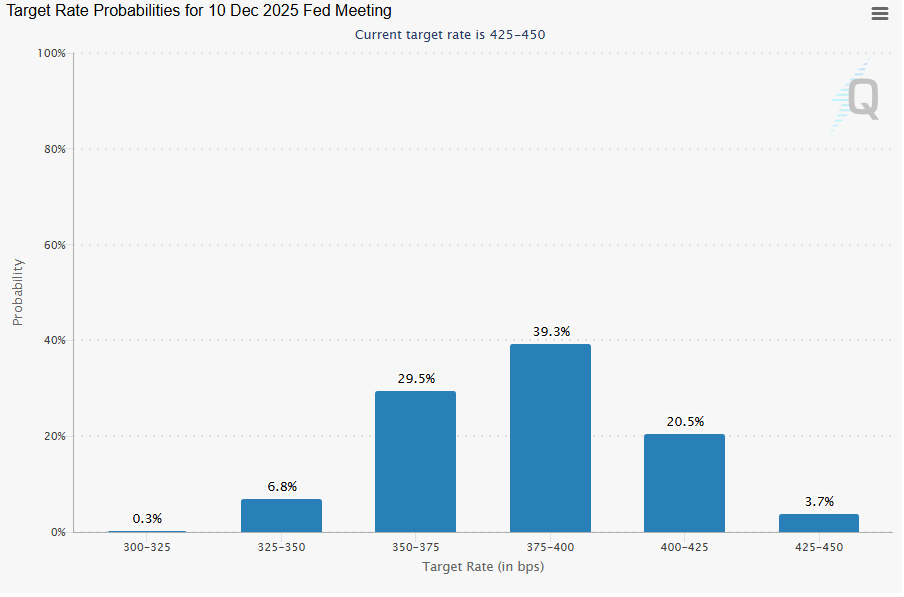

Markets now expect just 2 cuts in 2025 — pushed to Sept and Dec.

CME Fed Watch – Fed Funds Rate

The bottom line: Delaying rate cuts may unnecessarily damage a key sector of the economy — one that affects millions of Americans directly.

(Visit Fin Pro Marketing – The Best Marketing for Finance Professionals)